Analysing the Q2 FY26 Banking Trends in India: A Comparative Study of Advances and Deposit Growth

The Indian banking sector continues to demonstrate resilience and adaptability in a changing macroeconomic landscape. This study analyzes the provisional Q2 FY26 financial data of ten major Indian banks, encompassing both private (HDFC Bank, Kotak Mahindra Bank, RBL Bank, and YES Bank).

Introduction

The second quarter of the financial year 2025–26 (Q2 FY26) marks a critical juncture for India’s banking industry, reflecting the sector’s continued resilience amid evolving macroeconomic conditions. Despite global monetary tightening and domestic liquidity adjustments, Indian banks have exhibited steady growth in both advances and deposits. This article examines the provisional data for ten major Indian banks—ranging from large private sector institutions such as HDFC Bank and Kotak Mahindra Bank to major public sector players like Punjab National Bank (PNB), Bank of Baroda (BoB), and Union Bank of India—focusing on their advances and deposit growth trends.

Keywords

Indian Banking Sector; Q2 FY26; Advances Growth; Deposit Growth; Liquidity Management; Financial Stability; RBI; Private Sector Banks; Public Sector Banks; Credit Expansion

Overview of Credit and Deposit Dynamics

(Data Source: The Economic Times)

(Data Source: The Economic Times)

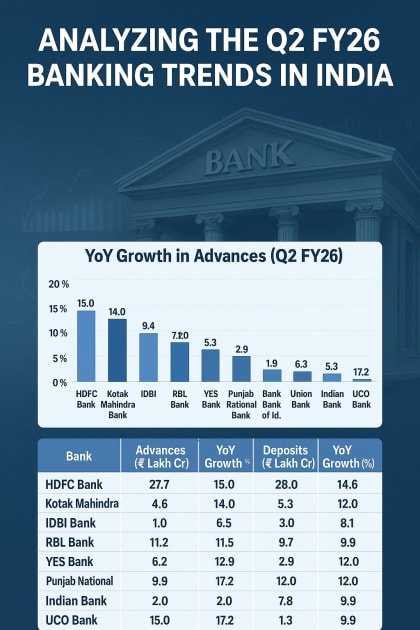

The Indian banking system’s credit expansion in Q2 FY26 underscores a robust demand for financing, driven by industrial recovery, retail consumption, and government-led infrastructure investments. As reflected in the data, most banks reported double-digit year-on-year (YoY) growth in advances, while deposit growth, though positive, showed relatively moderate momentum—an indication of tightening liquidity conditions and cautious depositor sentiment in the high-interest-rate environment.

Comparative Analysis of Private Sector Banks

HDFC Bank, India’s largest private lender, continues to dominate the credit landscape with total advances at ₹27.7 lakh crore, registering 15% YoY growth. Its deposit base expanded by 14.6%, suggesting balanced growth and efficient fund mobilization.

Similarly, Kotak Mahindra Bank posted advances of ₹4.6 lakh crore and deposits of ₹5.3 lakh crore, maintaining healthy growth rates of 14% and 12%, respectively. This balanced expansion reflects Kotak’s strong retail credit growth, supported by digital lending initiatives.

Smaller private banks such as RBL Bank and YES Bank also maintained upward trajectories, with YES Bank showing 11.5% growth in advances and 9.7% in deposits, signaling gradual recovery from its earlier asset quality concerns.

Performance of Public Sector Banks

Among public sector banks, Punjab National Bank (PNB) reported advances growth of 9.4% and deposits growth of 9.9%, reflecting a stable but cautious credit stance. Bank of Baroda demonstrated modest expansion with 5.3% growth in advances—one of the lowest among peers—while deposit growth was restrained at 1.9%, indicating challenges in deposit mobilization.

On the other hand, Union Bank of India and Indian Bank displayed robust performance. Indian Bank, in particular, emerged as a key performer with 17.2% growth in advances, the highest among the sampled banks, supported by strong corporate and retail loan portfolios.

Interpretation of Growth Trends

The data highlights a divergence between credit and deposit growth, raising structural questions about the sustainability of lending expansion amid tightening liquidity. While credit growth outpaced deposit accretion in most institutions, the potential risk lies in increased reliance on bulk deposits or market borrowings to fund loan growth, which could pressure net interest margins (NIMs) in upcoming quarters.

Moreover, the resurgence in advances signals renewed corporate borrowing and retail credit demand—an encouraging sign for the economy’s investment cycle. However, the moderation in deposit growth suggests households are channeling surplus funds into higher-yielding instruments such as mutual funds and debt securities, reflecting a shift in financial savings behavior.

Macroeconomic and Regulatory Context

The Reserve Bank of India (RBI), maintaining a cautious stance amid global uncertainties, has emphasized liquidity management and financial stability. The steady advances growth observed across the sector aligns with the RBI’s projections of 14–15% credit growth for FY26. Nonetheless, banks must navigate challenges related to liquidity costs, regulatory capital requirements, and potential asset quality risks in unsecured lending segments.

Outlook for FY26

Looking ahead, the Q3 and Q4 performance will likely determine whether the current growth momentum is sustainable. As India continues its infrastructure push and private capital expenditure picks up, the demand for bank credit is expected to remain strong. However, deposit mobilization will be the critical differentiator—banks with stronger retail franchise networks and innovative savings products are likely to maintain a stable cost of funds advantage.

Conclusion

The Q2 FY26 data underscores the Indian banking sector’s ongoing transformation—anchored by credit growth, digital integration, and improving asset quality. Private sector leaders such as HDFC and Kotak Mahindra continue to exhibit operational efficiency, while select public sector banks like Indian Bank and Union Bank have shown commendable progress in revitalizing their growth trajectories. The broader implication for policymakers and financial institutions lies in ensuring that this credit expansion remains sustainable, well-funded, and aligned with macroeconomic stability.

References:

The Economic Times; Data Source.

2. Reserve Bank of India (2025). Quarterly Banking Sector Performance Report – Q2 FY26.

3. Ministry of Finance (2025). Indian Banking Statistics and Financial Indicators. Government of India.

4. HDFC Bank & Kotak Mahindra Bank Investor Reports (Q2 FY26).

5. Business Standard (2025). “Credit Growth Outpaces Deposits: Liquidity Concerns in Indian Banking.”

6. Economic Times (2025). “Public Sector Banks Strengthen Balance Sheets Amid Credit Expansion.”