GST 2.0: Will Indian Shoppers Really Feel the Change?

India’s new GST 2.0 simplifies tax slabs to 5%, 18%, and 40%, aiming to ease compliance and lower prices. While early festive sales rose on anticipation, real impact depends on price pass-through, business adaptation, and consumer confidence.

GST 2.0: Will Indian Shoppers Really Feel the Change?

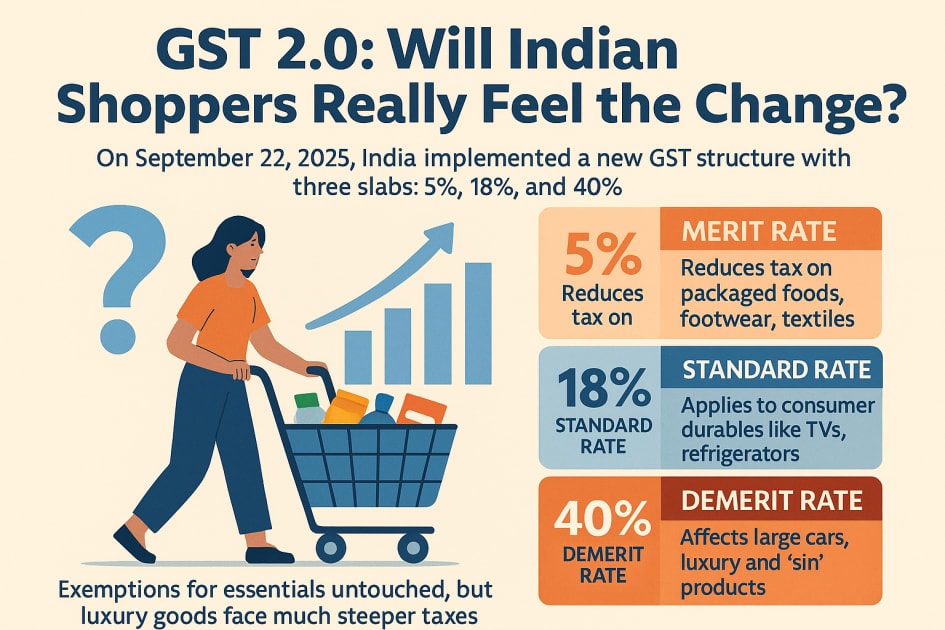

On September 22, 2025, India implemented a streamlined Goods and Services Tax (GST) system, simplifying the older multi-rate framework. The previous 5%, 12%, 18%, and 28% slabs have now been reduced to three: 5%, 18%, and 40%. Exemptions remain in place for essentials (0%), precious metals (3%), and cut diamonds (0.25%), but most activity will now fall under the core structure.

Consumer-facing changes are substantial. Common staples such as packaged food, ghee, biscuits, textiles, and footwear now fall under the 5% “merit rate.” Many durables like televisions, washing machines, and refrigerators—previously taxed at 28%—are now under the 18% “standard rate.” Luxury and “sin” goods have been consolidated into a single 40% slab, removing the earlier cess-plus-rate structure.

For households, this promises relief. For businesses, it offers administrative clarity. But whether it drives a real change in consumer behaviour depends on how effectively the rate changes reach people’s wallets.

Festival Spike: More Than Just GST

Navratri 2025 marked the strongest sales in over a decade. Sectors like autos, electronics, and fashion reported notable growth. Some attributed this to the new GST structure, but most price changes hadn’t reached shelves when the festival began. The uptick was driven more by anticipation than implementation.

Consumers expected upcoming price drops. Retailers and brands leaned into that sentiment, offering aggressive festive deals and financing. The psychological signal from the Council’s announcement added momentum, but GST wasn’t the sole engine behind the sales boom.

Lower Tax, Higher Scrutiny

Tax rate cuts don’t guarantee visible price reductions. Businesses with older inventory may not reprice immediately. Others may hold onto the margin. When the bill doesn’t reflect what the government promises, consumer trust erodes.

Whether GST 2.0 delivers depends on how clearly businesses pass on the savings. Price tags, revised MRPs, and communication at point-of-sale will shape perception. The new Invoice Management System, effective from October 2025, is designed to tighten input tax credit claims and improve compliance. It could push more firms toward transparency, especially in the organised sector.

Price-conscious consumers will likely respond where rate drops are steep—from 18% to 5% or 28% to 18%. A household switching from loose staples to packaged products, or finally upgrading a washing machine or scooter, reflects not just affordability but changing expectations about quality and formality.

High-End Segments Face Friction

Luxury goods, by contrast, now face a clear deterrent. The 40% slab replaces the older cess model with a more straightforward penalty. It applies to large vehicles, sin goods, and high-end consumption. Aspirational buyers may postpone or downshift. Others might look for tax-efficient alternatives.

Premium demand, always more sensitive to sentiment and regulation, could soften—especially if financing conditions tighten or discretionary income flattens.

Shaping Habits, Not Just Prices

GST also alters how services are consumed. Categories like salons, gyms, and budget hotels—now under the 5% rate—may see an uptick. These were previously taxed at 18%, which often discouraged middle-income households. If price was truly a barrier, usage could increase. But habit formation depends on more than affordability. It needs consistency in service quality, availability, and broader income stability.

Tax cuts alone won’t drive new demand unless they coincide with economic confidence. Inflation, rural wages, and credit access still matter more than policy announcements.

From Baskets to GDP

Private consumption contributes more than 60% to India’s GDP. If households shift toward more formal, taxable products and services, the impact on growth could be noticeable. A one percent sustained increase in real consumption could add roughly 60 basis points to GDP.

The Q3 FY26 festive quarter will likely reflect a short-term boost. Whether this momentum extends depends on how thoroughly businesses adapt and how strongly consumers respond to actual—not promised—price shifts.

What to Watch

Three signs will indicate success. First, whether brands update pricing and communicate it. Second, whether basket composition shifts toward formal and branded goods. Third, how smoothly MSMEs adapt to the compliance changes. Any friction—especially in rural or semi-urban supply chains—could delay benefits.

If these elements align, GST 2.0 could go beyond headline reform and drive meaningful behavioural shifts in how India shops and consumes.