“Rising Demand Makes Copper a Strong Investment Avenue for Indian Investors”

Copper demand in India is projected to surge, driven by infrastructure, clean energy, and manufacturing. With a significant global supply gap forecasted, rising prices make copper a strong, profitable investment avenue for Indian portfolios.

“Rising Demand Makes Copper a Strong Investment Avenue for Indian Investors”

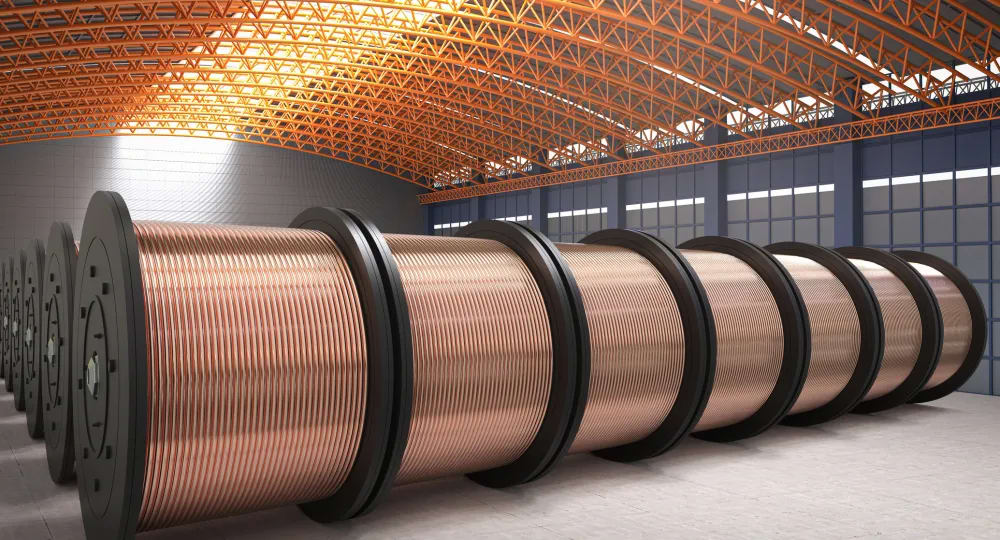

Copper is an important metal. It carries electricity well, lasts long, and is essential in many machines, wires, motors, electronic parts, and in renewable energy equipment like solar panels and wind turbines. Because of India’s fast growth, more infrastructure, more clean energy, more manufacturing, copper demand is rising—and many reports say it’s going to rise steeply in the coming years. Let’s look at the reasons, the numbers, and what India must do to keep up.

Global Context: Supply vs Demand

To understand India’s demand, it's useful to see what is happening globally:

According to the International Energy Agency (IEA), global demand for copper is set to increase significantly under current policies. Reports warn of a potential 30% shortfall in copper supply by 2035 if current mining, exploration, and refining projects don’t accelerate. IEA+2IEA+2

Global refined copper demand was roughly 26–27 million tonnes in 2024. Under the IEA's Stated Policies Scenario, that might grow to about 33 million tonnes by 2035 and around 37 million tonnes by 2050. Crux Investor+2IEA+2

Supply side problems: ore grades are declining, which means mines are producing less copper per amount of ore; discovery of new deposits has slowed; project lead times (from discovering a deposit to starting production) are long (often a decade or more). IEA+2CME Group+2

Thus globally, copper is becoming more “critical” in both senses: essential, and in possible shortage if action is not taken.

India is among the countries where copper demand is projected to rise sharply. Here are the key drivers and numbers.

Key Drivers for Indian Copper Demand

Manufacturing and Industrial Growth

India’s “Make in India” initiative, expansion of factories, industrial corridors, increased electronics and machinery production all raise copper needs. Copper is used extensively in electrical wiring, motors, switchgear, etc. The manufacturing sector is growing fast. IBEF+2IISD+2Infrastructure and Building Expansion

Urbanization means more homes, more commercial buildings, more roads, more metros. These require wiring, plumbing, and electrical systems—all copper‐intensive. Transmission lines, substations, and grid expansion are especially copper‐hungry. IISD+3The Economic Times+3IEA+3Clean Energy and Electric Mobility

To meet climate goals and reduce climate risk, India is pushing solar, wind, and EVs. Solar panels, wind turbines, battery plants, charging stations—they need copper. Also, upgrading power grids to handle variable renewable energy needs more copper in cables, transformers etc. IEA+2IISD+2Government Policies

Policies like incentives (PLI = Production Linked Incentives), push for self‐reliance (“Atmanirbhar Bharat”), trade negotiations, attracting foreign firms, trying to develop domestic smelting/refining. These policies help shape demand by making infrastructure, manufacturing and clean energy more feasible or cheaper. Reuters+3The Economic Times+3Discovery Alert+3Rise in prices of Gold and Silver

Gold and silver is forms an integral component in various manufacturing industries like electronics, solar energy, defence and aerospace and the steep continuous increase in prices of gold and silver is likely to force manufacturers to switch to use copper as an alternative to gold and silver in their manufacturing process.

Some Numbers: Projected Demand in India

Here are specific figures based on recent data:

In FY 2025, India’s imports of refined copper were about 1.2 million metric tonnes. Domestic refined copper production is much less. MetalMiner+2Reuters+2

According to a government document reported by Reuters, copper demand in India is expected to rise to 3.0–3.3 million tonnes by 2030. Reuters+1

By 2047, demand could reach 8.9–9.8 million tonnes, from that 1.2 million base. Reuters

PHDCCI (an industry organization) projects demand in India to grow about 7% in coming years because of clean energy projects and infrastructure development. The Economic Times

These numbers show big growth: roughly 2.5-3× increase from 2025 to 2030, and far more by 2047.

Matching Supply: Can India Keep Up?

There’s a big concern that demand may overtake supply unless India acts.

Current Shortfalls

India currently imports a large share of its copper needs, especially copper concentrates and refined copper. As demand rises, this dependence is expected to increase. Reuters+2IEA+2

The domestic mining output is much smaller relative to demand. India’s reserve base is there to some extent, but “reserves” that are technically and economically feasible to mine are far fewer. Reuters+1

Policy Responses

To deal with this, India is planning or doing:

Encouraging foreign investment / partnerships with global mining firms to set up smelters, refineries, and processing plant inside India. This helps reduce import needs and builds domestic capacity. Reuters+1

Negotiating trade/tie ups with copper rich countries to secure supply. Reuters+1

Improving regulation, incentives, and enabling infrastructure to speed up mining, refining, recycling. IEA+1

Potential Challenges

Even with strong drivers and policies, there are hurdles:

Long lead times and project delays: To open a new mine, set up a refinery or smelter, environmental clearances, land acquisition, funding all take many years. By the time all approvals are in place, the need could already be bigger. IEA+1

Resource quality: If copper ore grades decline, more ore must be handled to get same copper output. That raises cost, energy usage, environmental impact. IEA+1

Import dependency risks: Foreign price fluctuations, supply chain disruptions, geopolitical risks. If India imports most of its copper concentrates or refined copper, then changes abroad affect India. Reuters+1

Environmental and regulatory constraints: Mining and refining can hurt environment, need water, energy, land. Regulations can slow things. Also social acceptance matters.

“Copper: A Profitable Bet for Indian Investors”

Copper offers strong investment potential for Indian investors over the next five years. Reports from the International Energy Agency highlight a widening global supply-demand gap, with renewable energy, electric vehicles, and digital infrastructure driving higher consumption. India’s own demand is set to rise by 7% annually, supported by rapid manufacturing growth and clean energy expansion. Price trend analyses show copper’s steady long-term appreciation, while the copper-to-gold ratio indicates sustained industrial strength. With limited new mine supply, India’s growing import dependence, and rising global prices, copper stands out as a reliable, profitable commodity investment for medium-term portfolios.

Tags

Comments (1)

amazing work ...Your article has found resonance, and revalidation with ET Today.. Congratulations !! ################## Copper is the new gold? Why this reddish glow can help your portfolio grow... https://economictimes.indiatimes.com/markets/commodities/news/copper-is-the-new-gold-why-this-reddish-glow-can-help-your-portfolio-grow/articleshow/124112371.cms